Recruitment Funding: Which Option Suits Your Business?

28 February 2024

‘Cash is king’ may be an over-used phrase but it certainly rings true for recruitment businesses.

All recruitment businesses, whether start-up or established, placing perms or temps, face a cashflow challenge.

With perm hires, there’s usually a gap of several weeks between sourcing the worker and getting paid. Eight weeks or more is not uncommon depending on the notice period the worker must serve.

With temps or contractors, there’s usually a time lag between payments being due to workers and invoice payments being received from end clients, plus the complexity of tax and VAT payments to calculate and process in many instances too.

These issues can be addressed with a funding solution. Unfortunately, too many good recruitment businesses avoid using funding because they think it’s too expensive. Or they give an equity stake to a third party and relinquish control and revenue, simply because they aren’t aware of all the other options available.

The good news is that there are now more options available than ever before, and many include back office services to address the admin burdens associated with payments and invoices too.

The key is to understand recruitment funding options so you can get the right for your business for its current needs, securing your growth trajectory. In future, as your needs alter, you can switch to a different funding solution which is more appropriate to your changing needs.

What are your funding options?

All funding options help to release funds that are tied up in unpaid invoices. However, each option works slightly differently depending on whether you’re hiring temps or perms, and what stage of growth your company is in.

Funding options broadly include:

- 100% recruitment finance with back office

- Fund placement by placement

- Factoring

- Invoice discounting

- Equity release

Let’s look at each option and how it works.

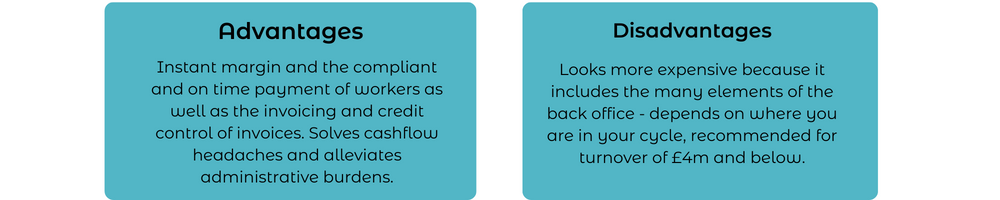

What is it?

100% recruitment finance, also referred to as 100% funding, is specifically designed for the recruitment industry. It involves the outsourcing of all invoicing and worker payment activities with the finance provider paying your agency margin upfront.

How it works:

Contractors/temps: The provider pays your contractor wages or Umbrella company, and pays your contract margin to keep you enabled with instant cash. The funder usually provides all the back office administration too, managing invoices, PAYE deductions and payments and collecting the funds.

Perms: On raising your perm invoice, you are advanced 80% of the fee minus charges and the remaining 20% is paid when the invoice is paid.

Best suited to:

All contract and perm-focussed recruitment businesses which need access to instant margin.

We see this option used effectively by both small and established recruitment businesses. By outsourcing invoicing and worker payments, there’s no need to spend your own time or have internal staff, systems and processes for managing invoices, payments and cashflow.

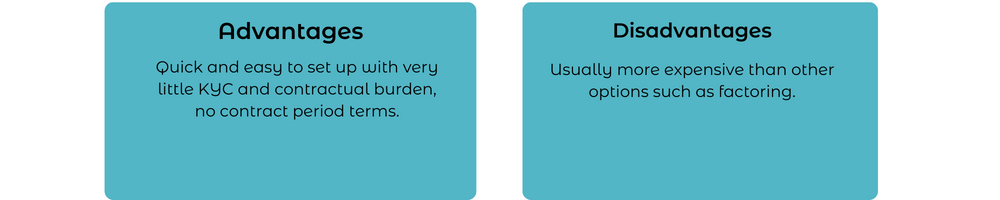

What is it?

The same as recruitment funding except that you only use the funding service when you need it.

How it works:

Contractors/temps: Access funding to pay workers on an ‘as and when’ basis. In addition, the provider manages the temp worker payment, tax submissions to HMRC and VAT deductions where appropriate.

Best suited to:

Perm recruitment business with the occasional contractor or temp to perm

We see this option used effectively by businesses that intend to remain perm-focused but which occasionally need to process a contractor/temp worker. The benefits of outsourcing the payment and invoicing usually outweigh the higher service charges whilst still ensuring you make a profitable placement.

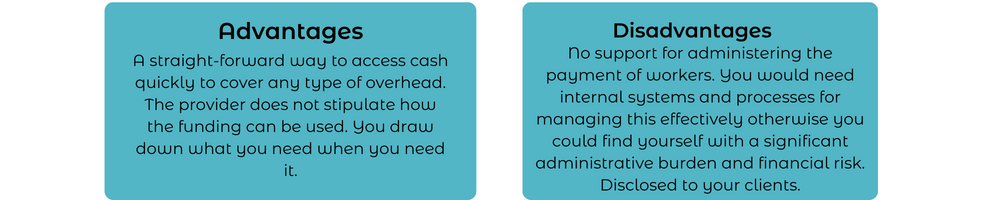

What is it?

A factoring company will advance money to your business based on the value of outstanding invoices.

How it works:

Factoring enables you to draw down money based on the value of invoices on your sales ledger. You can use the money received via factoring to meet any of your ongoing running costs. A factoring service will usually include credit control but does not always include other back office services, so you may be responsible for organising the correct and timely payment of workers.

Best suited to:

Contract-focused businesses with a back office solution. Perm focussed recruitment businesses with a growing contract/temp desk(s).

We see this option used effectively by businesses that need a truly flexible funding solution.

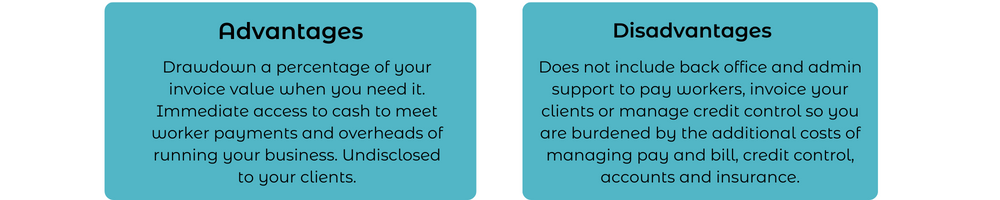

What is it?

Invoice discounting is usually provided by a bank which lends money based on the value of your total outstanding ledger.

How it works

You upload the total value of your invoicing each week. You are able to drawdown money to meet your worker payments and business running costs as and when you need it.

Best suited to:

Established to mature recruitment businesses.

We see this option used effectively when you have an established recruitment business with significant turnover and good internal or external support to run your back office.

What is it?

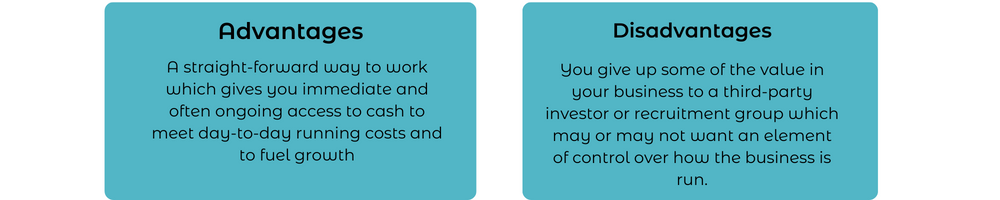

Equity investments provide an immediate and sometimes ongoing injection of cash in exchange for ownership of a part of your business.

How it works:

You sell/gift a chunk of your business in exchange for access to cash.

Best suited to:

Suits all sizes from start-up recruitment businesses, growing recruitment companies or owners who wish to divest and realise wealth.

We see this option used effectively when companies want to scale at pace or divest. It’s well suited to those with ambitious growth plans where the founders can still achieve their income goals whilst allowing a third party to have a share.

How to decide

We hope we have provided some clarity on recruitment funding options to help you think about what would suit your business best.

We can facilitate all funding options, so before you choose please do consult with our experienced team who will help you make the right choice.

Suggested Reads

Back-Office Support – What Agencies Should & Shouldn’t Outsource

Feb 4, 2026 Workwell News

Recruitment agencies are under constant pressure to manage costs, increase efficiency, and improve compliance, all while protecting client relationships and delivering excellent candidate experiences. Outsourcing is increasingly recognised as a…